Financial Management

Financial Management Startup inDinero May Be All-in-One, But It's Falling Short on the Customer Service Front

Founded in 2010 by then 20-year-olds Jessica Mah and Andy Su, inDinero is a Y-Combinator backed startup whose angel investors include the likes of Microsoft’s Fritz Lanman, Yelp’s Jeremy Stoppelman, and Youtube’s Jawed Karim. Understandably, much buzz surrounded the company upon its launch due to their young founders, and the buzz was backed up by a sleek design and simple interface that’s reminiscent of Mint.com.

In fact, the resemblance to Mint was one reason why businesses flocked to inDinero. Mint is extremely successful as a personal financial management solution because it’s easy to use and it’s free; but it doesn’t have the functionality to handle business finances, so SMBs are continually looking for that one product that can do everything that Mint does, but for their business. Fortunately, inDinero does offer that.

The Basics Behind inDinero

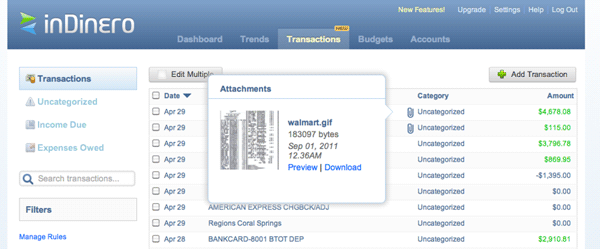

Aside from a visually appealing interface, what does inDinero do make organizing your finances easier? First of all, just like Mint, businesses only have to enter their financial login information into the system’s dashboard, which will then gather all financial transactions and bank statements and automatically sort them into categories to organize the data. inDinero can also automatically update your budget and deliver your latest financial data within minutes. While it’s not a replacement for an actual bookkeeper or accountant, it definitely makes the job much easier by eliminating much the data entry that comes with running a business’s finances.

In addition, users can add their receipts to the inDinero system and track expenses by uploading them through the dashboard or emailing them to inDinero. The inDinero team will then match the receipts to the corresponding transactions in your financial dashboards. If there are any discrepancies, you’ll receive an email alert to check out the issue. inDinero was offering a service last year where you could mail in your receipts and have them uploaded by their team, but it’s unclear as to whether this is still an option for inDinero users.

inDinero Doesn’t Necessarily Come Up All Roses

Much of the buzz around inDinero centers upon its young founder, whose story is certainly incredible and inspiring to entrepreneurs everywhere. However, a close look at the way that inDinero is run as a service raises a few concerns in my mind.

For example, unlike the majority of their competitors, they don’t offer a free trial or free account, something which they used to do. As of this month, you’re now forced to automatically upgrade to their small business account and enter your billing information when you sign up, but no indication of this is given before you’ve already created the account. Although the business plan is only $29.99 per month for unlimited transactions and users, that’s still $30 that you might not want to invest in taking a new financial solution for a test run, and there’s no way to delete your account unless you contact them directly.

On that front, it seems that their support may not be very quick to respond to your communications, judging by user comments and questions in the inDinero support center. While there are many happy customers, there are just as many irate and frustrated ones who cannot seem to get ahold of an inDinero representative to assist them with whatever issue they’re having.

If you’re a small business owner, inDinero’s clean UI and simple accounting tools can help you keep track of and organize your finances, but you may find yourself on your own when you need help navigating the system.

Looking for a financial management solution to benefit your company? Browse top product reviews and blog content on the financial management resource center page. You’ll find specialized content on expense management solutions, nonprofit accounting, electronic invoicing and more.