Payroll

Is Payroll Software More Difficult Than Doing Payroll Manually?

If you are setting up a new UK business, or have an established business that is considering changing to in-house payroll, you might be wondering whether you can manage payroll manually.

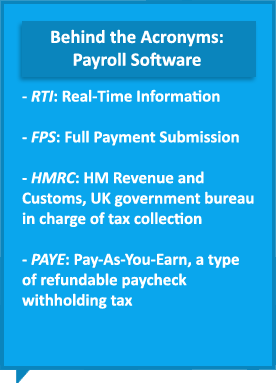

Amidst changes to HMRC’s payroll system and the introduction of PAYE in real time (RTI), it is no longer a question of whether payroll software is easier to use than manual payroll. If you are going to handle company payroll in-house, you must use a payroll system. This is because PAYE information now has to be sent to HMRC electronically, and there is no way to do this other than to use payroll software.

RTI payroll software from a reliable and reputable supplier makes payroll simple and efficient. Such software allows you to make payroll calculations, and the best systems will account for all of the common (and many of the less common) variations and complexities in payroll.

Payroll Software Features and Functionality

For example, solutions can calculate applicable taxes and Statutory Pay for each employee depending on how much they earn and how much they work. The same goes for unpaid sick leave. Variable hourly pay can be handled for irregular working patterns or seasonal staff, and payslips can be printed and emailed to employees. Software will also keep on top of changes to tax codes, keep detailed records of attendance and hours worked, and provide the necessary data for leavers.

For example, solutions can calculate applicable taxes and Statutory Pay for each employee depending on how much they earn and how much they work. The same goes for unpaid sick leave. Variable hourly pay can be handled for irregular working patterns or seasonal staff, and payslips can be printed and emailed to employees. Software will also keep on top of changes to tax codes, keep detailed records of attendance and hours worked, and provide the necessary data for leavers.

Business efficiency and the management and analysis of business costs are two very important topics, and this is where UK payroll software can prove to be really important. With detailed analysis and reporting, a company can understand their employment overheads and make well-informed decisions as circumstances change. Detailed reporting functions are very useful for larger companies that need to differentiate between various pay grades, departments and individual members.

The automation of year-end returns used to help to make things simpler, though now with the introduction of PAYE in real time the previous P14 and P35 returns are no longer required. This kind of information is now handled with the monthly Full Payment Submission (FPS), which includes information on the amount employees have been paid, deductions, and starter and leaver dates if they apply.

The Manual Input Side of Payroll Software

Just because a good RTI payroll software solution will automate much of the process and make calculations for you, this does not mean there is no manual work to perform. The payroll administrator will have to manually enter employee information and update rates of pay whenever they increase or decrease, as well as perform many other duties.

Good UK payroll software is not difficult to learn and to use, and with HMRC recognised UK payroll software you will have the resources you need to quickly learn how to use the system properly and manage real time PAYE with HMRC. New users benefit from software solutions that have extensive user manuals and a helpful user interface.

Want more information on the best payroll software solutions?

We’ve compiled the top product reviews, blog posts and premium content on our human resources software research page. Here, you’ll find all of the information you need to choose the right payroll software solution. Also, be sure to compare leading products in our Top 10 Payroll Software report, where we give you the lowdown on pricing, key features and technology models.